Is Full Coverage Insurance Worth It? A Comprehensive Analysis

Introduction

The decision to purchase car insurance involves weighing the benefits of coverage against the costs of premiums. Full coverage insurance, often touted for its comprehensive protection, raises questions about its necessity and affordability. This comprehensive guide explores the concept of full coverage insurance in depth, analyzing its components, benefits, costs, and considerations. By the end, you’ll have a thorough understanding to determine whether full coverage insurance is worth it for your individual circumstances.

Chapter 1: Understanding Full Coverage Insurance

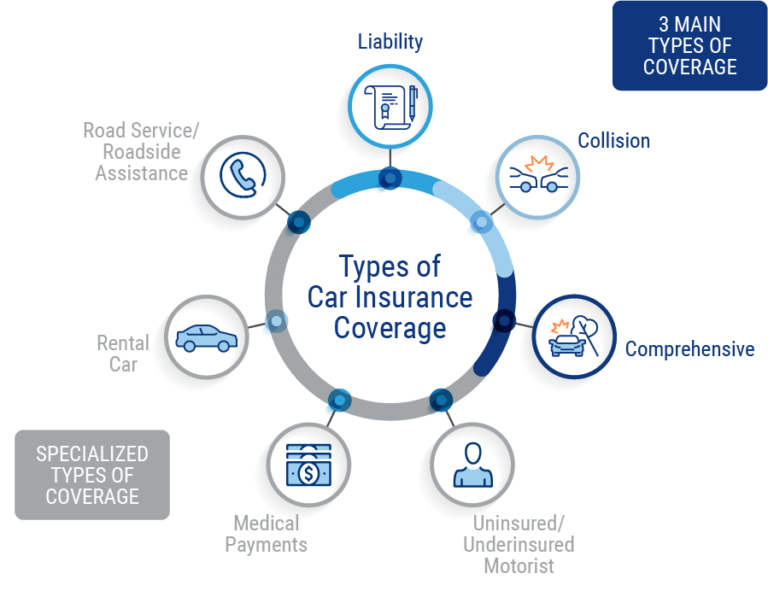

Full coverage insurance is a term often used loosely in the insurance industry. This chapter clarifies:

- Definition of Full Coverage: What does it typically include?

- Components: Breakdown of liability, collision, and comprehensive coverage.

- Exclusions: Situations not covered by full coverage policies.

Chapter 2: Benefits of Full Coverage Insurance

Full coverage insurance offers extensive protection. This chapter explores its advantages:

- Vehicle Protection: Coverage for damage in accidents.

- Comprehensive Coverage: Protection against non-collision incidents (theft, vandalism, etc.).

- Peace of Mind: Assurance against unexpected events.

- Loan or Lease Requirements: Compliance with lender requirements for financed vehicles.

Chapter 3: Evaluating Your Coverage Needs

Assessing your risk and financial situation is crucial. This chapter covers:

- Assessing Your Vehicle’s Value: Determining if your vehicle warrants full coverage.

- Personal Financial Situation: Considering your ability to cover repairs or replacements.

- State Requirements: Understanding minimum insurance requirements.

Chapter 4: Cost Considerations

Full coverage insurance typically comes with higher premiums. This chapter discusses:

- Premium Factors: What influences the cost of full coverage?

- Comparison with Liability-Only Policies: Cost differences and benefits.

- Ways to Lower Premiums: Strategies for reducing insurance costs.

Chapter 5: When Full Coverage Insurance May Be Worth It

Certain situations justify the cost of full coverage insurance. This chapter explores:

- New or Expensive Vehicles: Protecting high-value assets.

- High-Risk Drivers: Minimizing financial risk with comprehensive coverage.

- Financial Stability: Ensuring you can afford unexpected repair or replacement costs.

Chapter 6: When Full Coverage Insurance May Not Be Necessary

In some cases, full coverage may not be the best option. This chapter includes:

- Older Vehicles: Assessing if full coverage is cost-effective.

- Financial Constraints: Considering affordability and budget constraints.

- Low-Risk Driving Habits: Minimizing risk of accidents or vehicle damage.

Chapter 7: Additional Coverage Options

Supplemental coverage can enhance protection. This chapter covers:

- Uninsured/Underinsured Motorist Coverage: Protection from drivers with insufficient insurance.

- Medical Payments Coverage: Coverage for medical expenses after an accident.

- Rental Reimbursement Coverage: Reimbursement for rental car expenses.

Chapter 8: Understanding Policy Limits and Deductibles

Policy details impact coverage and costs. This chapter discusses:

- Coverage Limits: Ensuring adequate protection within policy limits.

- Deductibles: How deductibles affect premiums and out-of-pocket costs.

Chapter 9: Making an Informed Decision

Factors to consider before purchasing full coverage insurance. This chapter includes:

- Personal Risk Tolerance: Balancing peace of mind with financial considerations.

- Consulting with an Insurance Agent: Getting expert advice on coverage options.

- Reviewing Policy Terms: Understanding the fine print before signing.

Chapter 10: Comparing Insurance Providers

Choosing the right insurer is essential. This chapter explores:

- Reputation and Customer Service: Importance of reliable claims handling.

- Financial Stability: Evaluating the financial health of insurance companies.

- Policy Flexibility: Options for customizing coverage to your needs.

Chapter 11: Long-Term Considerations

Planning for the future with full coverage insurance. This chapter covers:

- Policy Renewals: Reviewing and adjusting coverage over time.

- Changes in Vehicle Value: Updating coverage as your vehicle depreciates or appreciates.

- Impact of Claims History: How claims affect future premiums and coverage options.

Chapter 12: Common Misconceptions About Full Coverage Insurance

Addressing myths and misunderstandings. This chapter includes:

- Cost-Effectiveness: Debunking beliefs about full coverage always being more expensive.

- Coverage Expectations: Clarifying what is and isn’t covered under full coverage policies.

- Comparative Analysis: Comparing benefits and drawbacks of different coverage types.

Chapter 13: Case Studies and Real-Life Examples

Illustrating scenarios where full coverage insurance was beneficial or unnecessary. This chapter includes:

- Case Study 1: A driver’s experience with comprehensive coverage after an accident.

- Case Study 2: An analysis of costs and benefits for an older vehicle owner.

- Real-Life Examples: Stories from drivers on their insurance decisions.

Chapter 14: Future Trends in Insurance Coverage

Technological advancements and industry changes impact insurance offerings. This chapter discusses:

- Usage-Based Insurance: Personalized premiums based on driving behavior.

- Advancements in Vehicle Safety: Impact on insurance claims and premiums.

- Environmental Considerations: Trends in eco-friendly vehicle coverage.

Conclusion

Deciding whether full coverage insurance is worth it requires careful consideration of your individual circumstances, financial situation, and risk tolerance. By understanding the components, benefits, costs, and alternatives to full coverage insurance, you can make an informed decision that best meets your needs and priorities. Remember, insurance needs may evolve over time, so periodic reassessment of your coverage is essential to ensure you have adequate protection.

Additional Resources

- Glossary of Insurance Terms

- Comparison Checklist for Insurance Quotes

- Sample Budgeting Worksheet for Insurance Costs

This comprehensive analysis aims to provide clarity on whether full coverage insurance is worth it for drivers. By exploring all facets of full coverage insurance—from benefits and costs to alternatives and future trends—you can navigate insurance decisions confidently and effectively protect your vehicle and financial well-being.