Steps to Take After a Car Accident: Insurance Claims Process

Introduction

Car accidents are unexpected and can be stressful events. Knowing what to do immediately following an accident can make a significant difference in how smoothly the insurance claims process unfolds. This comprehensive guide will walk you through each step after a car accident, from ensuring safety at the scene to navigating the insurance claims process effectively. By understanding these steps, you’ll be better prepared to protect your interests and get back on the road as smoothly as possible.

Chapter 1: Safety First – Immediate Actions After an Accident

The moments following a car accident are crucial for ensuring safety and preventing further harm. This chapter covers:

- Ensuring Safety: Immediate steps to take to secure the accident scene.

- Checking for Injuries: Assessing yourself and passengers for injuries.

- Calling Emergency Services: When and how to contact the police and medical assistance.

- Documenting the Scene: Importance of gathering evidence and taking photos.

Chapter 2: Exchanging Information with Other Parties

Communication and information exchange are vital for the claims process. This chapter includes:

- Exchanging Contact Information: What details to exchange with the other driver(s).

- Documenting Vehicle Information: Recording details about the vehicles involved.

- Obtaining Witness Information: Gathering statements and contact details from witnesses.

Chapter 3: Reporting the Accident to Your Insurance Company

Promptly notifying your insurance company is essential for initiating the claims process. This chapter discusses:

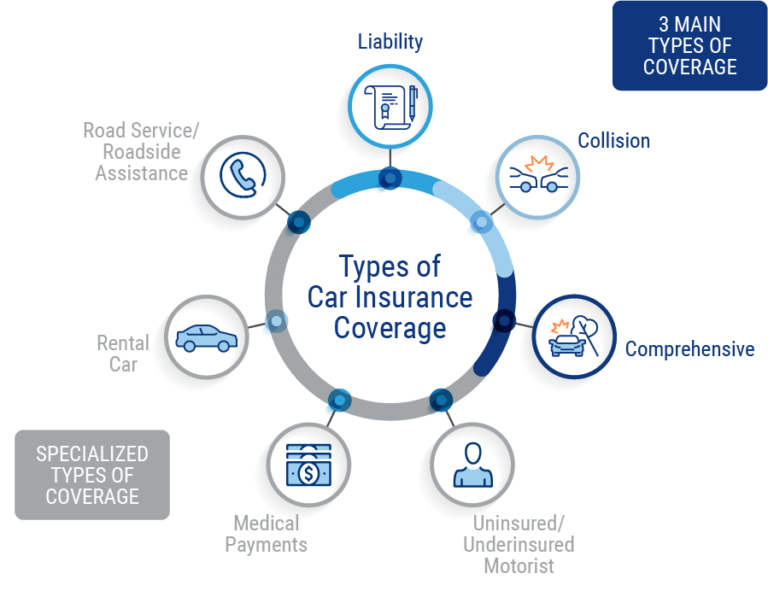

- Understanding Your Policy: Reviewing your insurance policy for coverage details.

- Contacting Your Insurer: How and when to report the accident.

- Providing Necessary Information: Details and documentation required by your insurer.

- Recording Your Version of Events: Providing an accurate account of the accident.

Chapter 4: Assessing Damage and Seeking Repairs

Understanding the extent of damage to your vehicle is crucial for repairs and insurance claims. This chapter covers:

- Getting a Repair Estimate: Visiting an authorized repair shop for assessment.

- Temporary Repairs: What can be done immediately to prevent further damage.

- Understanding Total Loss: When the vehicle is deemed a total loss and the process involved.

Chapter 5: Understanding the Claims Process

Navigating the claims process can be complex. This chapter provides a step-by-step guide:

- Initial Claim Review: How insurance companies assess your claim.

- Adjuster Assignment: Appointment of an adjuster to evaluate the damage.

- Claim Investigation: Gathering evidence and statements related to the accident.

- Resolution and Settlement: Negotiating a settlement with your insurance company.

Chapter 6: Dealing with Insurance Adjusters

Interacting effectively with insurance adjusters can impact your claim’s outcome. This chapter includes:

- Providing Documentation: Documents and evidence to support your claim.

- Understanding Adjuster’s Role: What adjusters do and their decision-making process.

- Negotiating Settlements: Tips for negotiating a fair settlement for repairs or total loss.

- Appealing a Decision: Steps to take if you disagree with the adjuster’s assessment.

Chapter 7: Handling Medical Claims and Personal Injury

Addressing medical claims and personal injuries requires specific attention. This chapter discusses:

- Seeking Medical Attention: Importance of medical treatment after an accident.

- Medical Documentation: Gathering medical records and bills for insurance claims.

- Personal Injury Claims: Understanding coverage for personal injuries.

- Long-Term Treatment and Rehabilitation: Insurance coverage for ongoing medical needs.

Chapter 8: Rental Car Coverage and Temporary Transportation

Arranging for alternate transportation is often necessary after an accident. This chapter covers:

- Rental Car Coverage: Understanding if your policy includes rental car reimbursement.

- Temporary Transportation: Options available if your vehicle is not drivable.

- Policy Limitations: Limits and conditions for rental car coverage.

Chapter 9: Resolving Disputes and Legal Considerations

Sometimes disputes arise during the claims process. This chapter includes:

- Legal Advice: When to consider consulting with a lawyer.

- Dispute Resolution Options: Mediation, arbitration, or litigation.

- Understanding Legal Rights: Knowing your rights when dealing with insurers.

Chapter 10: Impact on Insurance Premiums and Future Coverage

Accidents can affect your insurance rates and future coverage options. This chapter discusses:

- Impact on Premiums: How accidents influence insurance premiums.

- Policy Renewal Considerations: Reviewing options at policy renewal.

- Improving Driving Record: Steps to mitigate the impact on premiums.

Conclusion

Navigating the aftermath of a car accident involves understanding the necessary steps and effectively communicating with insurance companies and other parties involved. By following the guidance in this comprehensive guide, you can streamline the claims process, ensure your rights are protected, and work towards resolving the situation as smoothly as possible. Remember, timely action and accurate documentation are key to a successful insurance claim after a car accident.

Additional Resources

- Checklist for Accident Documentation

- Sample Insurance Claim Form

- Contact Information for Legal Advice