The Importance of Medical Coverage in Car Insurance: A Comprehensive Guide

Introduction

Car accidents can result in injuries ranging from minor cuts to severe trauma requiring extensive medical treatment. Medical coverage in car insurance plays a crucial role in ensuring that drivers, passengers, and pedestrians involved in accidents receive necessary medical care without financial strain. This comprehensive guide explores the importance of medical coverage in car insurance, including its components, benefits, coverage options, costs, and considerations. By understanding these aspects, you can make informed decisions about including medical coverage in your insurance policy to protect yourself and others on the road.

Chapter 1: Understanding Medical Coverage in Car Insurance

Medical coverage is a fundamental component of car insurance policies. This chapter covers:

- Definition and Purpose: What medical coverage includes and its primary objectives.

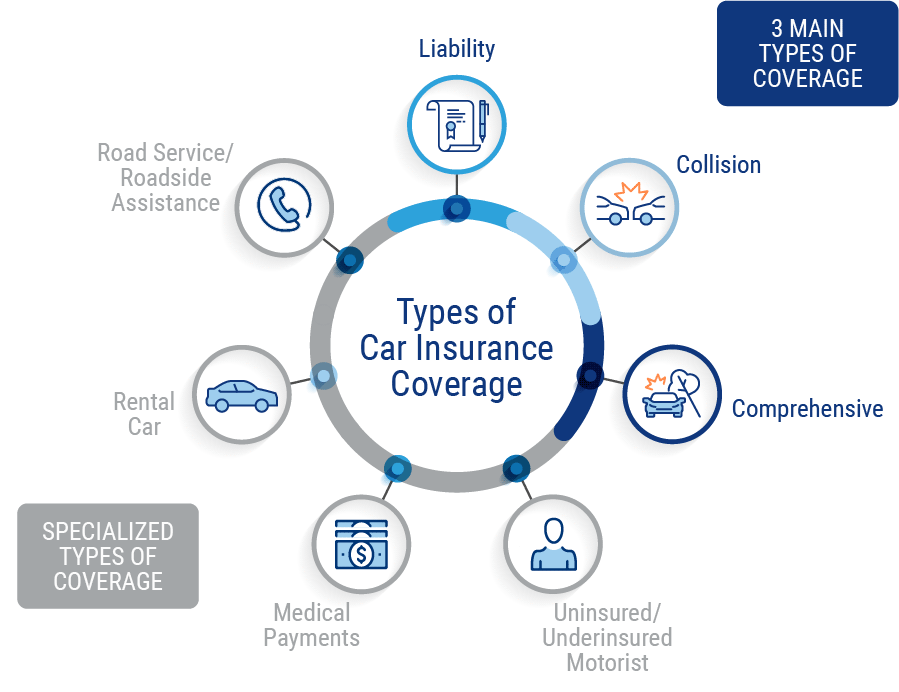

- Types of Medical Coverage: Overview of personal injury protection (PIP), medical payments coverage (MedPay), and bodily injury liability coverage.

- Legal Requirements: State-specific regulations regarding medical coverage in car insurance.

Chapter 2: Importance of Medical Coverage After Car Accidents

Car accidents can result in various injuries, making medical coverage essential. This chapter explores:

- Immediate Medical Needs: Addressing injuries promptly to prevent complications.

- Access to Treatment: Ensuring timely medical care for all parties involved.

- Financial Protection: Shielding against high medical expenses and potential lawsuits.

Chapter 3: Components of Medical Coverage

Understanding what medical coverage includes is crucial for policyholders. This chapter discusses:

- Medical Expenses Coverage: Reimbursement for medical bills related to car accident injuries.

- Rehabilitation Costs: Coverage for physical therapy and other rehabilitation services.

- Long-Term Care: Financial support for ongoing medical needs resulting from accidents.

Chapter 4: Benefits of Medical Coverage

Medical coverage provides numerous benefits beyond immediate medical expenses. This chapter covers:

- Financial Security: Protection against unexpected medical costs.

- Peace of Mind: Assurance that medical needs will be covered after an accident.

- Coverage for Passengers: Benefits extend to passengers in your vehicle.

Chapter 5: Coverage Options Available

Car insurance policies offer various options for medical coverage. This chapter explores:

- Personal Injury Protection (PIP): Coverage for medical expenses, lost wages, and other related costs.

- Medical Payments Coverage (MedPay): Immediate reimbursement for medical bills without waiting for liability determination.

- Bodily Injury Liability Coverage: Coverage for medical expenses of others injured in accidents you cause.

Chapter 6: State-Specific Considerations

Medical coverage requirements and options vary by state. This chapter includes:

- No-Fault States: Explanation of no-fault insurance laws and implications for medical coverage.

- Minimum Coverage Requirements: State-mandated minimums for medical coverage.

- Optional Enhancements: Additional coverage options available beyond state minimums.

Chapter 7: Costs of Medical Coverage

Understanding the financial implications of medical coverage is essential. This chapter discusses:

- Premium Factors: How premiums are calculated based on coverage limits and deductibles.

- Comparative Costs: Analysis of medical coverage costs compared to potential out-of-pocket expenses.

- Ways to Lower Premiums: Strategies for reducing insurance costs while maintaining adequate medical coverage.

Chapter 8: Medical Coverage and Health Insurance Coordination

Car insurance medical coverage often interacts with health insurance policies. This chapter covers:

- Primary vs. Secondary Coverage: Determining which insurance pays first.

- Coordination of Benefits: Ensuring efficient processing of medical claims.

- Policy Limitations: Understanding coverage limits and exclusions under both policies.

Chapter 9: Handling Claims and Reimbursements

Navigating the claims process for medical coverage is crucial for timely reimbursement. This chapter includes:

- Filing a Medical Claim: Steps to initiate a claim with your insurance company.

- Documentation Requirements: Providing necessary medical records and bills.

- Claims Investigation: How insurers assess medical claims and determine coverage.

Chapter 10: Legal and Financial Protection

Medical coverage in car insurance offers legal and financial safeguards. This chapter discusses:

- Legal Defense Coverage: Protection against lawsuits related to car accident injuries.

- Financial Stability: Mitigating the risk of personal bankruptcy due to medical expenses.

- Personal Liability Coverage: Ensuring coverage for injuries caused to others.

Chapter 11: Impact on Premiums and Policy Renewals

Medical coverage decisions affect insurance premiums and policy terms. This chapter explores:

- Premium Adjustments: Factors influencing premium rates for medical coverage.

- Policy Renewal Considerations: Reviewing coverage needs and adjustments at renewal.

- Long-Term Planning: Planning for changes in medical and insurance needs over time.

Chapter 12: Enhancing Safety and Preventive Measures

Preventing accidents through safety measures reduces the need for medical coverage. This chapter covers:

- Vehicle Safety Features: Impact on accident prevention and insurance premiums.

- Driver Training Programs: Benefits of defensive driving courses.

- Safe Driving Practices: Minimizing the risk of accidents and injuries.

Chapter 13: Special Considerations and Situations

Unique situations may require specific insurance considerations. This chapter includes:

- High-Risk Occupations: Insurance options for drivers in hazardous professions.

- Coverage for Uninsured Motorists: Protection against uninsured drivers.

- Travel and Rental Vehicles: Insurance options for temporary or international travel.

Chapter 14: Future Trends in Medical Coverage and Car Insurance

Technological advancements and industry changes impact medical coverage options. This chapter discusses:

- Integration of Technology: Use of telematics and data analytics in insurance.

- Telemedicine Services: Influence on medical claims processing and coverage.

- Policy Innovations: Emerging trends in personalized insurance products.

Conclusion

Medical coverage in car insurance is essential for protecting yourself, passengers, and others involved in accidents. By understanding the components, benefits, costs, and considerations of medical coverage, you can make informed decisions to ensure adequate protection against unforeseen medical expenses and legal liabilities. Remember, assessing your coverage needs and staying informed about insurance options are key to securing comprehensive insurance that meets your needs and budget.

Additional Resources

- Glossary of Insurance Terms

- Checklist for Reviewing Medical Coverage Options

- Sample Insurance Claim Form

This comprehensive guide aims to provide clarity on the importance of medical coverage in car insurance. By exploring its components, benefits, costs, and practical considerations, you can navigate insurance decisions confidently and ensure you have adequate protection in the event of car accidents and related medical expenses.