The Role of Technology in Car Insurance Claims: A Comprehensive Analysis

Introduction

Technology has revolutionized every aspect of our lives, and the insurance industry is no exception. In the realm of car insurance, technological advancements have significantly transformed the claims process, making it more efficient, accurate, and customer-friendly. This comprehensive guide explores the evolving role of technology in car insurance claims, from the use of artificial intelligence (AI) and machine learning to telematics devices and mobile apps. By delving into these technologies, their impact on claims management, benefits, challenges, and future trends, this guide aims to provide a thorough understanding of how technology is reshaping the landscape of car insurance claims.

Chapter 1: Evolution of Car Insurance Claims Processing

The traditional methods of handling car insurance claims have evolved with technological advancements. This chapter covers:

- Historical Overview: How claims processing was managed before technological integration.

- Early Technological Adaptations: Introduction of computers and digital databases.

- Current State: Transition to advanced technologies like AI, IoT, and mobile solutions.

Chapter 2: Key Technologies Shaping Car Insurance Claims

Several technologies play crucial roles in modern car insurance claims management. This chapter explores:

- Artificial Intelligence (AI): Use of AI for claims assessment, fraud detection, and customer interaction.

- Machine Learning: Algorithms that analyze data to improve claims processing efficiency and accuracy.

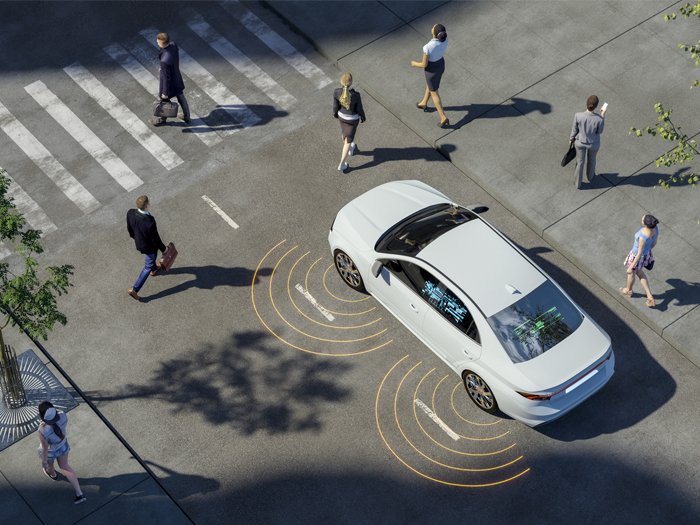

- Telematics Devices: Usage-based insurance (UBI) and real-time data for claims verification.

- Mobile Apps: Customer-centric apps for filing claims, tracking progress, and communication.

Chapter 3: Benefits of Technological Integration in Claims Processing

Technology enhances various aspects of car insurance claims. This chapter discusses:

- Faster Processing Times: Reduction in claim settlement times through automated processes.

- Improved Accuracy: Enhanced data analytics for precise claims assessment and decision-making.

- Cost Efficiency: Reduction in operational costs associated with claims handling.

- Enhanced Customer Experience: Seamless digital interactions and transparency in the claims process.

Chapter 4: Enhanced Data Analytics and Claims Assessment

Data analytics plays a pivotal role in modern claims assessment. This chapter covers:

- Predictive Analytics: Forecasting claim outcomes based on historical data and patterns.

- Fraud Detection: Identifying suspicious claims through advanced analytics and AI algorithms.

- Claim Severity Analysis: Assessing the extent of damage and injury to determine appropriate compensation.

Chapter 5: Telematics and Usage-Based Insurance (UBI)

Telematics devices and UBI programs revolutionize how insurance companies assess risk and handle claims. This chapter explores:

- Data Collection: Gathering real-time driving behavior data through telematics.

- Risk Assessment: Using telematics data to adjust premiums and evaluate claims.

- Personalized Pricing: Tailoring insurance premiums based on individual driving habits.

- Impact on Claims: Faster and more accurate claims processing with telematics insights.

Chapter 6: Role of AI and Machine Learning in Claims Management

AI and machine learning algorithms streamline claims processing and enhance decision-making. This chapter discusses:

- Claims Automation: Automating routine tasks such as document verification and claim validation.

- Customer Interaction: AI-driven chatbots and virtual assistants for customer support.

- Claims Fraud Detection: Machine learning models to detect fraudulent claims patterns.

- Predictive Analytics: Forecasting claim outcomes and optimizing resource allocation.

Chapter 7: Mobile Apps and Self-Service Claims Filing

Mobile apps empower policyholders with self-service claims filing and management capabilities. This chapter covers:

- Ease of Access: Instant access to claims filing and policy information.

- Document Submission: Uploading photos and documents directly through mobile apps.

- Claims Tracking: Real-time updates on claim status and next steps.

- Customer Feedback: Feedback mechanisms for improving app usability and customer satisfaction.

Chapter 8: Challenges and Limitations of Technological Integration

Despite the benefits, technological integration in car insurance claims faces challenges. This chapter includes:

- Data Privacy Concerns: Safeguarding sensitive customer data and compliance with regulations.

- Integration Complexity: Challenges in integrating legacy systems with new technologies.

- Customer Adoption: Ensuring policyholder comfort with digital interactions and self-service options.

- Cybersecurity Risks: Mitigating threats of data breaches and cyber attacks.

Chapter 9: Regulatory and Legal Implications

Regulations shape how insurers deploy and use technology in claims processing. This chapter explores:

- Compliance Requirements: Adhering to data protection laws and regulations (e.g., GDPR, CCPA).

- Ethical Considerations: Ensuring fairness and transparency in AI-driven decision-making.

- Legal Frameworks: Impact of regulatory changes on technological innovations in insurance.

Chapter 10: Future Trends in Technology and Car Insurance Claims

The future holds exciting possibilities for further integrating technology into car insurance claims. This chapter discusses:

- Blockchain Technology: Potential for secure and transparent claims processing.

- Augmented Reality (AR) and Virtual Reality (VR)**: Enhancing claims assessment and customer interactions.

- AI Advancements: Continued evolution of AI capabilities in claims management.

- Customer-Centric Innovations: Anticipated enhancements in mobile apps and customer experience.

Chapter 11: Case Studies and Real-Life Examples

Examining real-world applications of technology in car insurance claims. This chapter includes:

- Case Study 1: Successful implementation of AI for claims automation in a major insurance company.

- Case Study 2: Telematics-driven claims resolution and customer satisfaction improvement.

- Real-Life Examples: Stories from policyholders and insurers on technological impact on claims experiences.

Chapter 12: Global Perspectives on Technological Adoption

Technological adoption varies globally, impacting insurance practices differently. This chapter covers:

- Regional Differences: How technological advancements influence insurance markets worldwide.

- Regulatory Variations: Compliance challenges and opportunities in different regions.

- Industry Collaboration: International partnerships for advancing technology in insurance claims.

Chapter 13: Collaboration Between Insurers and Technology Providers

Partnerships between insurers and technology firms drive innovation in claims processing. This chapter explores:

- Strategic Alliances: Collaborations to enhance technological capabilities.

- Tech Integration Challenges: Overcoming barriers to seamless integration.

- Impact on Industry Dynamics: Transformative effects of tech-driven collaborations.

Chapter 14: Conclusion

Technology continues to redefine car insurance claims processing, offering benefits such as efficiency, accuracy, and improved customer experiences. By embracing AI, machine learning, telematics, and mobile solutions, insurers can streamline operations and meet evolving customer expectations. However, challenges such as data privacy, regulatory compliance, and cybersecurity must be addressed to maximize the potential of technology in insurance claims. Looking ahead, continued innovation and strategic partnerships will shape the future of car insurance claims, ensuring a seamless and transparent experience for policyholders worldwide.

Additional Resources

- Glossary of Technology and Insurance Terms

- Checklist for Evaluating Technological Solutions in Claims Processing

- Sample Customer Survey on Technology in Claims Management

This comprehensive guide aims to provide a thorough exploration of the role of technology in car insurance claims. By examining key technologies, benefits, challenges, future trends, and real-world examples, readers gain insights into how technological advancements are reshaping the landscape of car insurance claims management.